Nagpur News Legal

Nagpur: Do not donate if you have doubts, says HC while rejecting PIL questioning PM CARES fund

The Nagpur bench of Bombay High Court, on August 26, rejected a Public Interest Litigation (PIL) filed by city-based advocate Arvind Waghmare, who questioned the operation of PM CARES Fund and sought declaration of details of receipts and expenditure from the PM CARES Fund on its official website.

Waghmare had approached the court asking it to issues directives to PM CARES to immediately appoint/nominate three other trustees on the fund, with at least two of them belonging to opposition members of Parliament to have proper check and balance,to strengthen the confidence of public and for transparency.

Apart from the appointment of SARC Associates as auditors, advocate Waghmare requested appointment of independent auditor only after formation of full board trustees, as per guidelines. Waghmare, who claimed to be a donor to the fund, submitted that the scheme of fund itself required PM Modi to nominate three eminent persons in the field of research, health, science, etc, as other trustees, but no appointments were made in terms of the trust deed. He also questioned the validity of decisions, which have been taken by the fund so far.

The court dismissed each petition filed by Waghmare and later advised him or any other donor to any public charitable trust to choose the discretion like John Falstaff, a cowardly Shakespearean character, to not donate if they have any doubt about its proper utilisation.

Additional solicitor general Anil Singh strongly opposed the PIL claiming that it was more of a publicity interest litigation with underlying political agenda. Citing the fact that Waghmare had contributed an amount of Rs 1,001 to the fund on May 8 and filed the PIL on May 9, claiming to be a contributor, Singh questioned the intentions of petitioner.

Waghmares PIL was dismissed by a bench compromising Justice Sunil Shukre and Justice Anil Killor on the grounds that the fund was a public charitable trust and was governed by its own registered deed of trust, which does not receive any government fund or budgetary support.

The will of the founding trustees and not the wishful thinking of the outsiders in such a case is what matters, is what prevails over desire of strangers and is what will receive reverence from law as long as the will is expressed by the trustees in tandem with law about which there can be no dispute here, the bench said.

There is yet another perspective to look at the prayer. The contributions, which are to be made to the fund are voluntary in nature and there is no compulsion for anyone to donate. If any person has any doubt about the application of the money, he intends to donate, may we remind such person of the words of Falstaff, a cowardly character portrayed by William Shakespeare in his play Henry IV that, The better part of Valour is Discretion; in the which better part, I have saved my life. Here ?life? can be taken to be money. So, such a person would well be within his right to not donate his money to the fund. From this perspective also no insistence can be made by a person donating his money in his discretion upon making of public disclosures of utilisation of the fund money on a public platform, bypassing the proper platform provided under the Trust Act applicable to a charitable trust like the PM CARES Fund.

As rightly submitted by Additional Solicitor General of India (Anil Singh), this relief (public disclosure of receipts and disbursement of funds money) is already adequately taken care of by the provisions made in the Registration Act and Trust Act applicable to the fund. The real question is why the public disclosure and why not the public disclosure. Proper utilisation of the fund money sourced from proper persons can be seen to be more than fulfilled in the present case by registration of fund as charitable trust and appointment of a chartered accountant who would be bound to balance and audit accounts of the funds in accordance with the provisions in the Trust Act, the bench further said, adding, In the Trust Act, there is already provided an effective mechanism for achieving the purpose for which the public disclosure (about receipts of and disbursement from the fund money), has been sought. Any person having interest in the trust is free to resort to that mechanism for redressal of his grievance.

The petitioner contends that as three trustees haven’t been nominated, the present board is incomplete and as such it is incapable of taking any decision. So, the decision to appoint the CA firm is without the wisdom of the board. The power of the honourable Chairperson of the fund to nominate three eminent persons as trustees is enabling in nature, not mandating him to nominate them always and at all times. That being so, no writ can lie to compel the authority to exercise the discretion and that too the way it is desired by a party. Decision of the board of trustees to appoint M/s SARC Associates as CA is taken in its wisdom and knowledge and upon application of mind and therefore can’t be assailed, the bench further added.

Legal

HC asks Joint District Registrar to pay back excess stamp duty of Rs 23 lakh collected from SDPL

Representational Image

The Nagpur Bench of Bombay High Court has ordered the Joint District Registrar, Nagpur, to pay back Rs 23,03,810, which was collected as excess stamp duty from Sandeep Dwellers Private Limited (SDPL).

While Adv Kartik Shukul appeared for SDPL, Assistant Government Pleader NR Patil appeared for The Joint District Registrar and other two respondents – The State of Maharashtra and The Inspector General of Registration.

SDPL, which is into construction, entered into one development agreement on December 28, 2020, and two agreements on December 31, 2020. The agreements were registered on February 10, 2021, January 1, 2021, and June 29, 2021, respectively. Before execution of the development agreements, SDPL made an application under Section 31 of the Maharashtra Stamp Act, 1958, for adjudicating upon the stamp duty chargeable on the development agreements.

Under the application, SDPL contended that since the development agreements were covered by government notification dated August 28, 2020, issued by Revenue and Forest Department, which reduced stamp duty chargeable on conveyance as per Article 25(b) of Schedule I of the Stamp Act, the development agreements were liable to be charged with lesser stamp duty. The notification dated 28.8.2020 had reduced the stamp duty chargeable on conveyance under Article 25(b) by two per cent for the period between 1st September 2020 to 31st December 2020 and by one and half per cent for the period from 1st January 2021 to 31st March 2021.

This contention of SDPL, however, was not accepted by the Joint District Registrar, who by an order passed on December 12, 2020, held that full stamp duty as is prescribed under Article 5(g-a) read with Article 25(b)(i), Schedule I of the Stamp Act, would have to be paid by SDPL. The petitioner abided by the adjudication and went ahead to execute the agreements on the dates mentioned earlier.

After hearing arguments from Adv Shukul and Adv Patil, the court partially allowed SDPL’s petition. The court quashed the December 18 order and directed the Joint District Registrar to refund the stamp duty paid in excess of the duty, which was required to be paid in respect of each of the three development agreements as per the rate stated in the notification dated August 28, 2020. The Joint District Registrar has been ordered by court to pay back the excess stamp duty within eight weeks. During its ruling, the court rejected SDPL’s request for interest on the said amount.

Giving an insight on the ruling, Adv Shukul told Nation Next, “This opens doors for other builders, who entered into development agreements registered during this period in the Maharashtra, to get a 2% refund of stamp duty, if it was collected in excess from them.”

Legal

Major relief for Nagpur family as MahaRERA issues order against Sahara City Homes

In a setback to Sahara City Homes ? a housing project of Sahara group’s real estate arm ? and a major win for Nagpur based advocates Rishabh R Agrawal and Suyash R Agrawal, Maharashtra Real Estate Regulatory Authority (MahaRERA) granted relief to Sanjay Bansilal Paliwal and Bansilal Namumal Paliwal against the real estate giant.

Legal

Unijules MD Faiz Vali rubbishes Rhugved Pharmaceutical’s accusation of dengue medicine trademark infringement

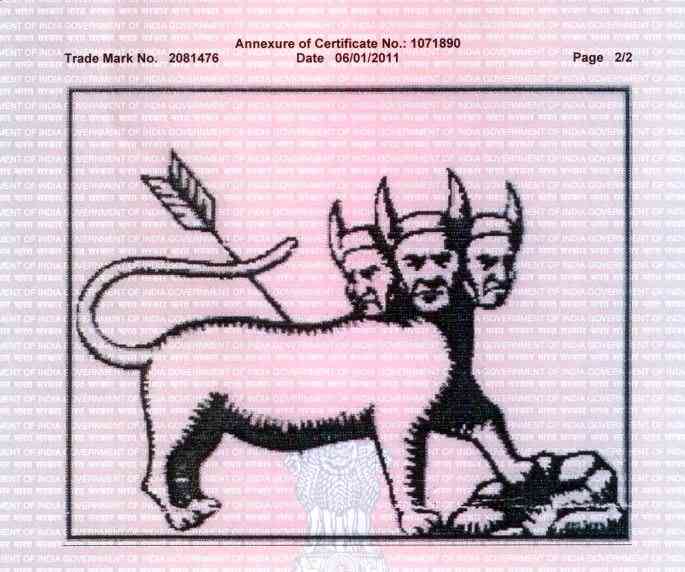

Teen Mundi Chhap medicine sold by Rhugved Pharmaceuticals (L) and Chaar Mundi Chaap medicine sold by Unijules Group.

Two Nagpur-based pharmaceutical companies have locked horns over a trademark used for selling dengue/malaria medicine. As a result of the tussle, on September 25, Rhugved Pharmaceuticals, situated in Dhantoli, filed a complaint with Shanti Nagar Police against the managing director and directors of 89-year-old Unijules Group situated in Kalmeshwar.

In the complaint, Dr Yashwant Ambatkar from Rhugved has stated that from November 10, 2011, to September 24, 2021, Unijules used a ‘Char Mundi’ logo similar to the ‘Teen Mundi’ logo allegedly owned by Rhugved to sell the dengue medicine. Ambatkar further alleged that Unijules gave advertisements in the newspaper stating that ‘Teen Mundi Chaap’ medicine is now ‘Chaar Mundi Chaap’ medicine. As a result of the complaint, Shanti Nagar Police have called managing director Faiz Vali and two directors DK Belani and Amit Chhabra for statement.

Speaking to Nation Next, Vali rubbished the allegations levelled against Unijules by Rhugved. Vali said: “We have been selling the medicine ‘Febronal’ – used for fever, pain and dengue – since 1946. The Teen Mundi trademark was registered by us under the provisions of the Trade Marks Act 1999 on January 6, 2011. The trademark is valid till 2030. When we got to know that Rhugved is selling the same kind of medicine under the name ‘Febromal’ with a different variation of the Teen Mundi logo, we decided to use the ‘Chaar Mundi Logo.’ We gave advertisements in newspapers stating that Teen Mundi Chaap medicine will now be sold by us as Chaar Mundi Chaap during 2010-2011. We have also applied for tradmark of Febromal Char Mundi Chaap which is under consideration.

The ‘Teen Mundi’ trademark registered by Unijules in January 2011.

Vali added: “This is an attempt by Rhugved to stop us from selling the medicine. They have been trying to do that since many years.” Vali, who has been called for his statement by Shanti Nagar Police on September 27, has now decided to file a complaint against Rhugved and is also contemplating legal action.

-

Social3 years ago

Social3 years agoPoliticians, businessmen shower blessings on Chandrashekhar Bawankule’s son Sanket at his wedding reception

-

Social3 years ago

Social3 years agoNagpur gets its first 7 am cafe ‘SEVEN O’ ELEVEN’ at Shraddhanand Peth

-

Parties3 years ago

Parties3 years agoCouples have a blast, win awards at ‘Hollywood Oscar Night’ in Nagpur

-

Politics3 years ago

Politics3 years agoShatrughan Sinha, Prithviraj Chavan grace Ranjeet Deshmukh’s 75th birthday celebrations in Nagpur

-

Social3 years ago

Social3 years agoSunil Kedar kicks off 10-day Late Dr Shrikant Jichkar Memorial Cricket Tournament in Nagpur

-

Parties3 years ago

Parties3 years agoFamily, friends ‘wine n dine’ at Dr Shilpa Mukherji’s birthday bash in Nagpur

-

Politics3 years ago

Politics3 years agoDisgruntled Ashish Deshmukh resigns as Maharashtra Congress General Secretary

-

Remembrance3 years ago

Remembrance3 years agoRenowned singer KK passes away at 53